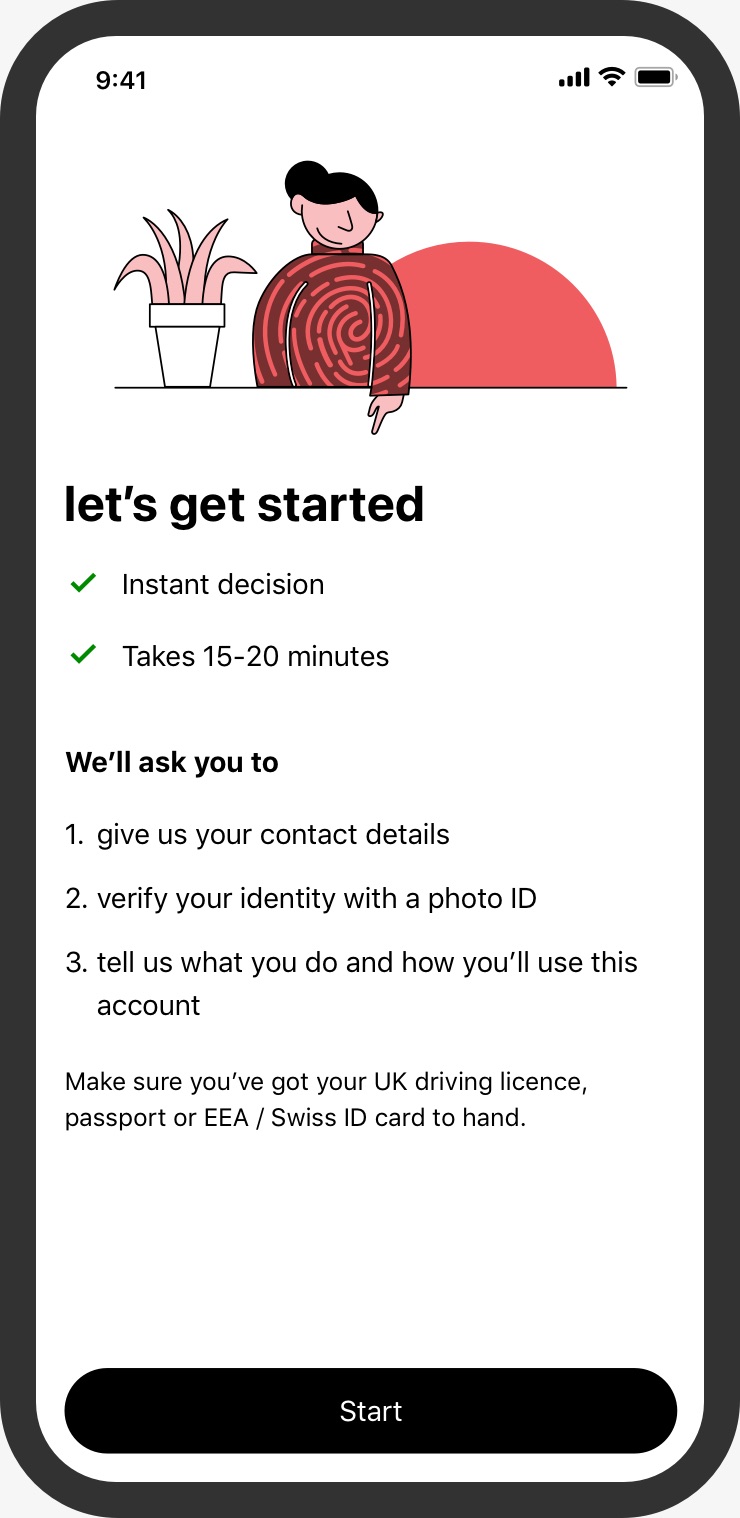

Step 1: Open an account

Switching your everyday banking to your new first direct account is easy. Once your first direct account is open, simply log into your first direct app, select the account you wish to transfer into, tap 'switch to us' from your account menu and follow the instructions. We will ask you for your account details, existing account details and preferred switching date.

Step 2: We'll let your old bank know

Once we’ve received your switch request and your current account is open, we’ll let your old bank know you're moving.

Step 3: Switching Days 2 to 6

We set up all your regular payments on your new first direct 1st Account. We tell all your Direct Debit originators you've moved banks and give them your new details, including your employer so your salary can be redirected. There's nothing at all for you to do, no calls or anything.

Step 4: Switching Day 7

Job done! Your old bank account will close on the date of your choosing, and you'll be able to see the balance from your old account in your shiny new first direct 1st Account.

We'll then let you know the switch is complete. It really is that easy.

Subject to status. UK residents only.

Our £175 bank account switch offer ended on 22 April 2024. If you applied to switch your bank account to us on or before this date you can still get our offer. You just need to be a new customer, complete a full switch, including at least 2 Direct Debits or standing orders, pay in £1,000 and log on to digital banking, within 30 days of your account opening.