Get into a good savings habit

Put away between £25 to £300 each month with our Regular Saver Account and we’ll give you a fixed rate of 7.00% AER/Gross for 12 months.

Put away between £25 to £300 each month with our Regular Saver Account and we’ll give you a fixed rate of 7.00% AER/Gross for 12 months.

Put away between £25 and £300 by standing order each month and get a fixed rate of 7.00% AER/Gross p.a. for 12 months.

Each day, we’ll calculate the interest on your account balance and the interest earned on previous days. We’ll add the interest to your account balance after 12 months, and then transfer it all to your Savings Account. If you don’t have a Savings Account, we’ll convert your Regular Saver into one.

You can apply for a Regular Saver via our App or Online Banking, and we’ll get you set up within a few hours to 3 days.

This account is only available to first direct 1st Account customers. Find out more about our 1st Account.

Your interest

Our Regular Saver gives you a 7.00% AER/Gross p.a. interest rate. We’ll calculate your interest daily, based on your account balance and the interest earned on previous days. We’ll add the total interest to your account balance after 12 months.

Here’s a guide on the interest you could earn.

| Monthly deposit example | Total deposit after 12 months | Interest earned | Balance after 12 months |

|---|---|---|---|

| Monthly deposit example£25 per month | Total deposit after 12 months£300 | Interest earned£11.38 | Balance after 12 months£311.38 |

| Monthly deposit example£300 per month | Total deposit after 12 months£3,600 | Interest earned£136.50 | Balance after 12 months£3,736.50 |

AER stands for Annual Equivalent Rate. This shows you what the gross rate would be if interest were paid and compounded each year.

Gross is the rate of interest paid before any tax (where applicable) has been deducted.

New to first direct?

You need to be a 1st Account holder to get access to our Regular Saver Account. Find out how to apply for our 1st Account below.

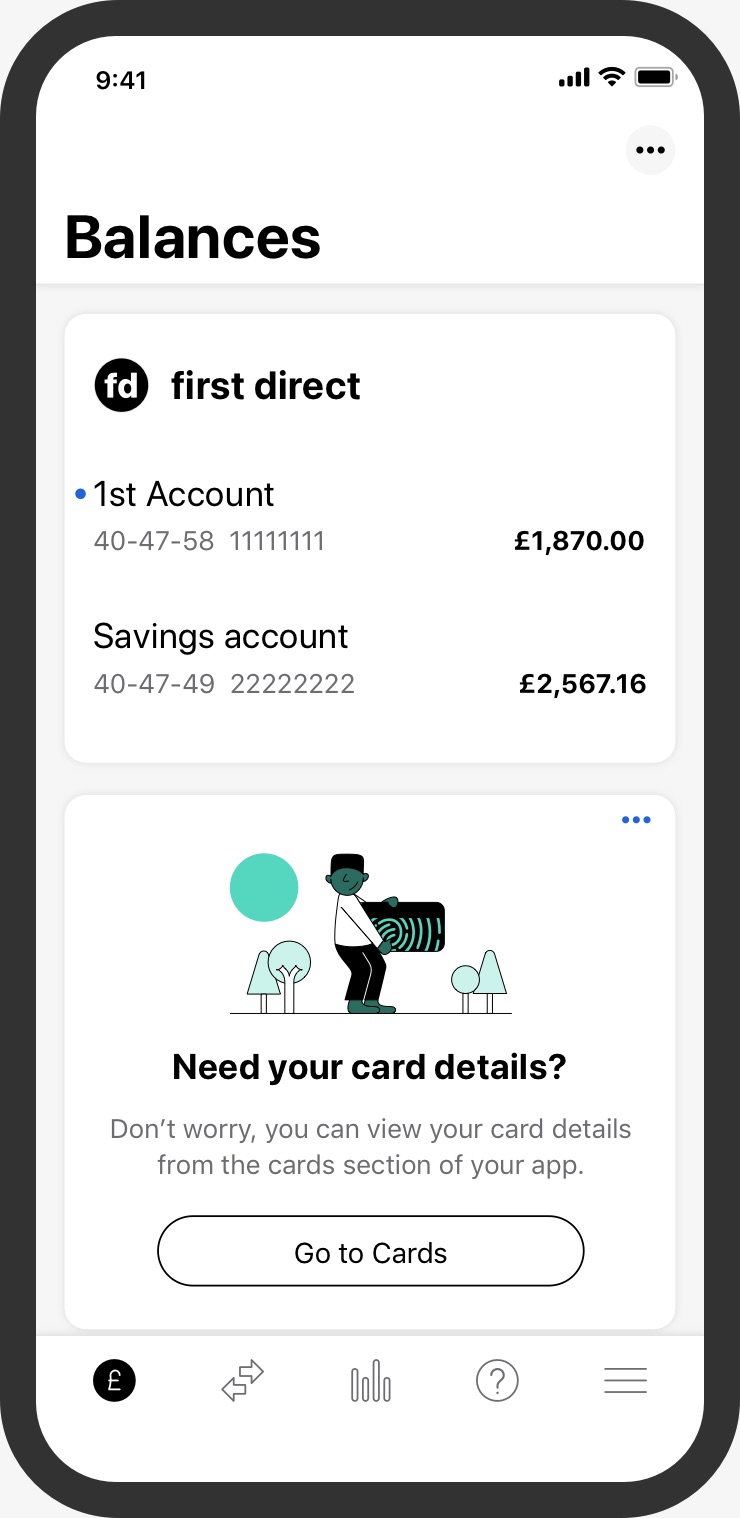

Existing 1st Account customers

Apply now through our first direct App:

1. Log in to the App.

2. Open the menu.

3. Select ‘Products’ then ‘Regular Saver'.

Alternatively, you can log on to Online Banking to apply.

Please have a read through the following.

Account Terms and Conditions and Charges (PDF)

Interest Rate and Charges (PDF)

Your eligible deposits with HSBC UK Bank plc are protected up to a total of £85,000 or up to £170,000 for joint accounts, by the Financial Services Compensation Scheme, the UK's deposit guarantee scheme.

This limit is applied to the total of any deposits you have with the following: HSBC UK Bank plc and first direct. Any total deposits you hold above the limit between these brands are unlikely to be covered.